Bank of Japan Payment Organization Bureau also mentions DeFi (decentralized

Bank of Japan DeFi Review

Mr. Masashi Hojo and Mr. Junichiro Hatogai, who belong to the Payment Organization Bureau of the Bank of Japan (hereinafter referred to as the Bank of Japan), have released a report on “The emergence of autonomous financial services and the search for governance” regarding crypto assets.

The report introduces the search for a mechanism related to DeFi (decentralized finance), and points out regulatory issues while broadly touching on crypto asset swaps, lending and borrowing, yield pharming, derivatives, custody, insurance, governance tokens, etc. did.

The report first touched on the size of the DeFi market these days and pointed out that its total investment balance (total lock value) has increased more than 60 times since the end of April last year. According to DeFiPulse, the total operating balance of Ethereum-based DeFi is over $ 64 billion.

Next, we introduced the mechanism of DEX (Distributed Exchange).

Introduction of DEX

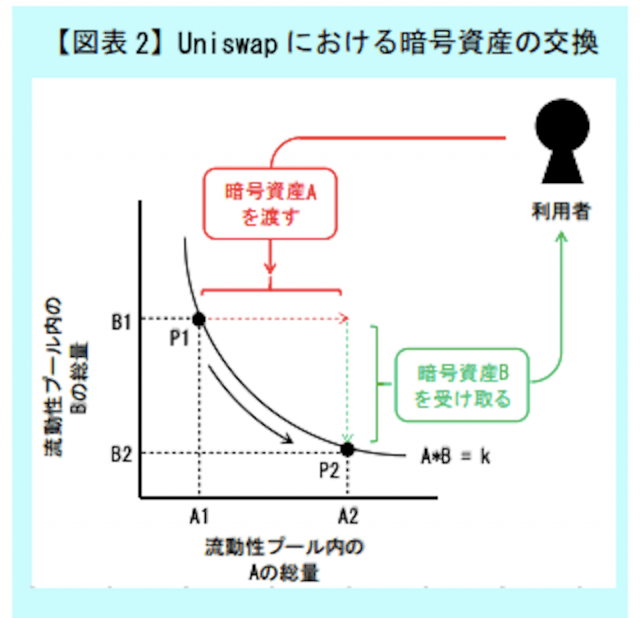

In the introduction of DEX, the report took up Uniswap, which is a typical DEX based on Ethereum, as an example.

The mechanism covers the basic elements of Uniswap, such as the mechanism of price fluctuations in the supply and exchange of liquidity in the liquidity pool, and the generation of liquidity tokens (including rewards).

Source: BOJ

Relation: Ethereum highest price update, soaring background: Uniswap V3 etc.

Lending market

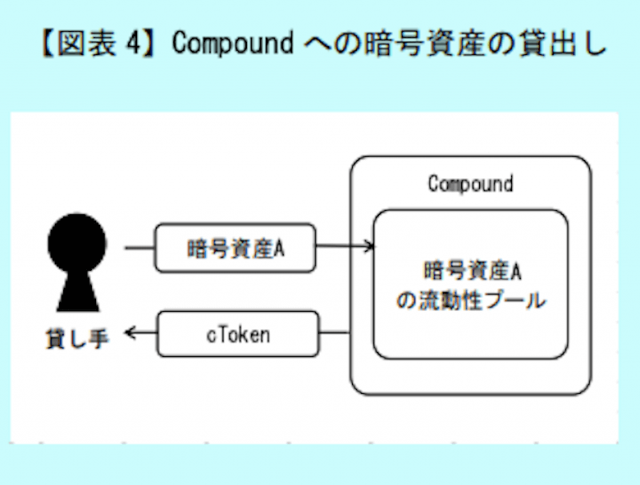

In addition to DEX, he explained operation examples of lending protocols.

Regarding Compound, the top platform of the lending protocol, the report states, “Lenders pledge (lock) crypto assets into the liquidity pool as collateral, and in exchange receive a” cToken “that acts as a deposit certificate.The lender can return the cToken at any time and collect the amount of the deposited cryptographic assets plus interest. “

Source: BOJ

Also mentions speculative risk

In addition, the report talked about the mechanism and risks of yield pharming in DeFi.

Yield pharming is an initiative to obtain the largest return by changing the liquidity supply destination according to the interest rate that constantly changes due to the balance between supply and demand.

Liquidity mining refers to the granting of governance tokens (tokens that express the right to participate in governance) in addition to interest in consideration of providing liquidity in order to attract people who perform yield pharming.

He took up the case of Uniswap’s UNI token and Compound’s COMP token, and touched on governance rights such as voting rights granted to them.

On the other hand, since yield pharming is based on the ratio of token issuance, there are many cases of mass profits aiming for high yields in a short period of time, and caution is also given to the risk that can cause a sharp drop in token prices. It has been done.

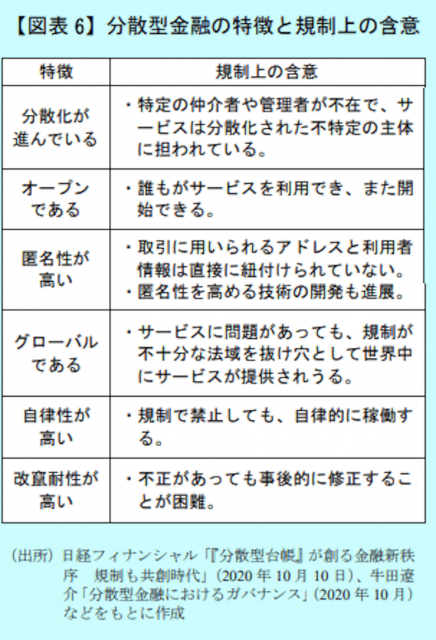

The report, citing the Financial Stability Board (FSA) report, carries with it the potential benefits of decentralized financial technologies such as DeFi, as well as the risks of lack of regulatory protection and smart contract failures. “Even if you try to prohibit it by regulation, it will operate autonomously and cannot be stopped, and even if there is fraud, it is difficult to take a method of correcting it later,” he also pointed out the difficulty of regulation. doing.

Source: BOJ

N https://imgs.coinpost-ext.com/uploads/2021/04/boj-digital-yen-.png-

Reference: Bank of Japan Review

Images used under Shutterstock license

“Cryptocurrency” means “cryptographic assets”

Read More: Bank of Japan Payment Organization Bureau also mentions DeFi (decentralized