How Deutsche Bank Avoided Bill Hwang’s Archegos Risk Under CEO Christian Sewing

On the day before one of the biggest margin calls in history, Deutsche Bank AG chief Christian Sewing joined an urgent meeting with a not-unfamiliar message: there was a problem, and billions of dollars were at stake.

But as executives on the late-March call briefed him on the bank’s exposure to Archegos Capital Management, this time it wasn’t all bad news. Risk managers had been concerned by the family office’s rapid growth for some time, and had been collecting additional collateral. And the firm’s traders stood ready to quickly offload the slumping assets.

So as Archegos’s collapse slammed rivals with more than $10 billion of losses, Deutsche Bank walked away without a scratch, reporting its highest profit in seven years. It was enough to stun longtime observers of the firm, which has spent the past decade-and-a-half stumbling from one crisis to the next. The escape added to a growing sense that Sewing may finally be moving Germany’s largest bank past its dysfunction of the last decade.

“What they pulled off is quite impressive in the last couple of years,” said Matthew Fine, a portfolio manager at Third Avenue Management who started investing in Deutsche Bank shares after Sewing was appointed CEO in 2018. “After several failures and years of incredible underperformance and substantial capital raisings, at some point you really have to rip the band aid off, and Sewing seems to have done that.”

Halfway through the CEO’s radical four-year restructuring, the perennial sick man of European finance appears to be on the mend. Its shares have more than doubled from a record low, when the pandemic revived old fears whether Germany’s largest lender was strong enough to survive another crisis. Instead of collapsing under bad loans, Deutsche Bank successfully rode a trading wave that’s buoyed investment banks globally. After years of gloom, some executives inside the Frankfurt headquarters are now even considering deals as they seek to profit from the recent stumbles of rivals.

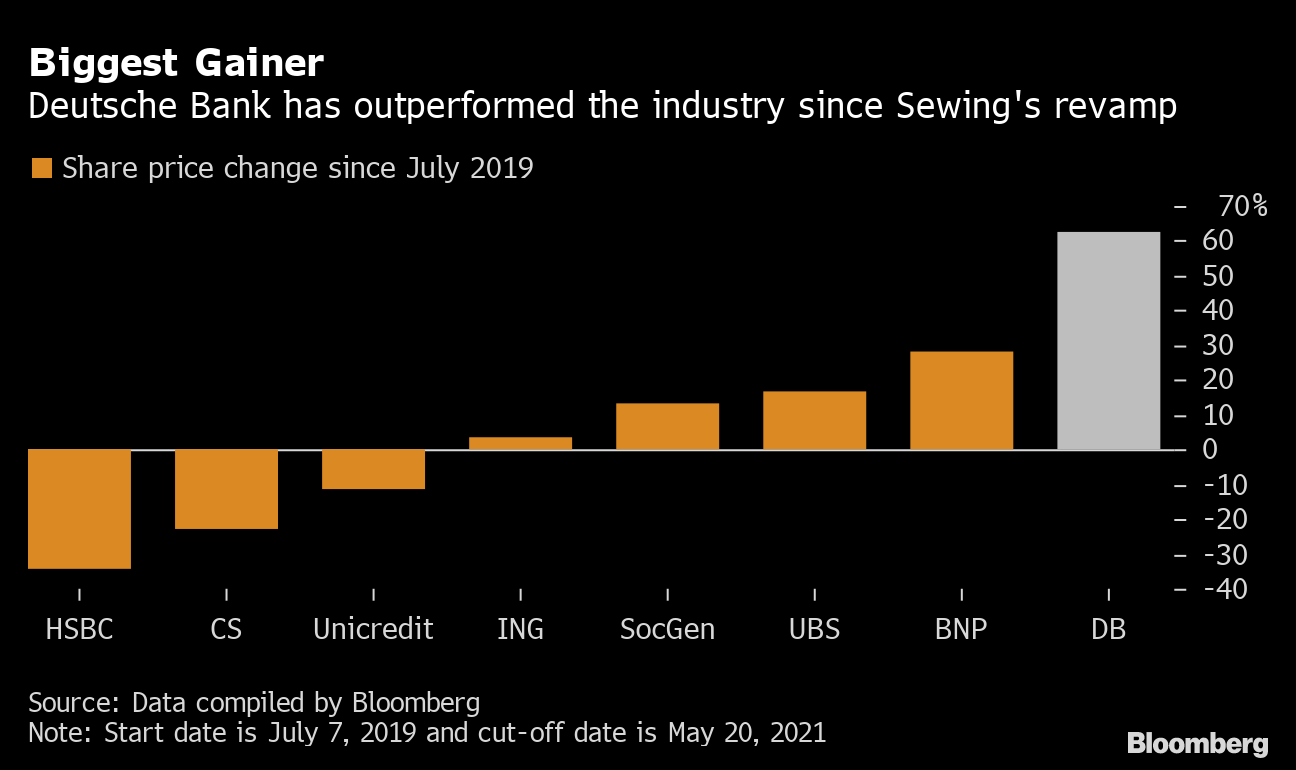

Biggest Gainer

Deutsche Bank has outperformed the industry since Sewing’s revamp

Source: Data compiled by Bloomberg

To be sure, for a bank that lost money in five of the past six years and whose shares remain 87% below their peak, the bar to success is low and blunders remain an ever-present possibility. The stock is still trading at one of the steepest discounts to book value among European lenders. Sewing’s efforts have gotten a boost from factors outside his control, such as the global market rally and extensive government guarantees that kept defaults at bay during the pandemic.

Christian Sewing at Deutsche Bank’s 2018 AGM.

Photographer: Krisztian Bocsi/Bloomberg

But the CEO, who had initially planned to focus more on corporate banking and cut back trading even more, was quick to adapt when markets moved against him just weeks after he announced his plan. At home, he’s confronted the reality that in order to make money in an overbanked country with negative interest rates, he needs to raise fees and slash jobs, even at the risk of upsetting clients and unions.

Above all, however, the former risk manager has made progress dealing with internal issues that had undermined his predecessors. He ended the divisional infighting that Sewing once called “Deutsche Bank’s disease,” and he addressed risk lapses that had caused the bank, over and over again, to shoot itself in the foot.

Archegos wasn’t the first blowup that Deutsche Bank sidestepped under Sewing. The bank last year avoided taking a potentially damaging financial and reputational hit from the collapse of payments firm…

Read More: How Deutsche Bank Avoided Bill Hwang’s Archegos Risk Under CEO Christian Sewing