US leveraged loan fund assets surge anew as investors eye floating-rate debt

U.S. leveraged loan fund coffers grew by another $4 billion in March as retail and institutional investors continued to focus attention toward floating-rate debt.

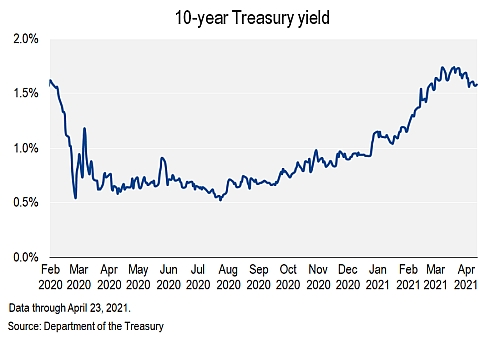

The most recent monthly inflow was the fifth straight for the asset class — AUM has surged by more than $20 billion since November 2020, according to Lipper — amid continued talk of inflation and rising Treasury yields, the latter of which reached 1.74% on March 31.

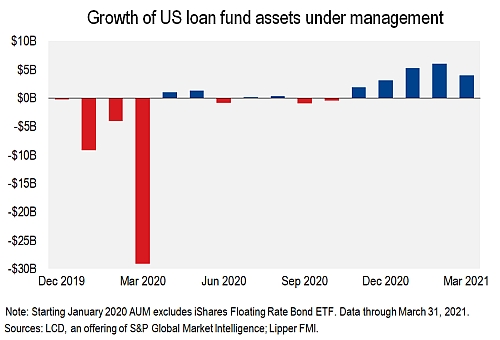

This swelling of loan fund assets in 2021’s first quarter followed a brutal stretch for the asset class. Loan fund AUM dipped by $41.8 billion from January 2020 through October, punctuated by an epic $29 billion redemption in March ($9 billion of this decline was a due to the removal of one bond fund from the ranks.)

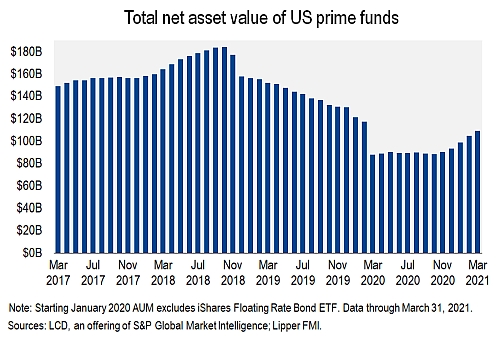

The recent activity brings loan fund AUM to $109 billion, its highest since February 2020 and before the COVID-19 pandemic and subsequent lockdowns battered economies and shuttered the loan market. Of note last month, the hefty asset growth received no help from rising secondary prices, unlike in months previous when trading levels were rebounding from COVID-induced lows. Indeed, while overall loan assets grew by 3.84% in March, the market value change was negative 0.24% during the month, following 10 months of notable market value boosts to AUM.

March was the first month since the pandemic onset in which where overall loans returns slipped into the red, according to the S&P/LSTA Leveraged Loan Index.

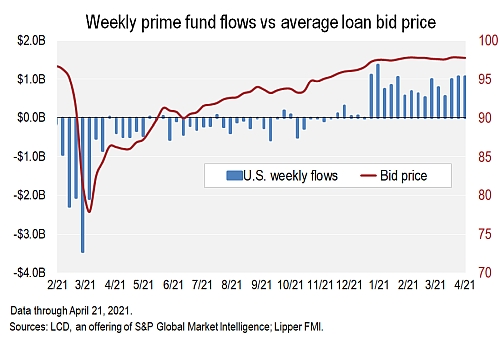

About those retail investors: They continue to pour cash into the asset class. So far in 2021, loan mutual funds and exchange-traded funds have seen a net $13 billion inflow, according to Lipper weekly reporters. That is a dramatic turnaround from 2020, when loan funds saw some $19 billion in redemptions. Illustrating the profound investor shift toward floating-rate debt and away from fixed-rate assets, high-yield funds and ETFs so far in 2021 have seen redemptions totaling $8.7 billion, after taking in a massive $38 billion in 2020, according to Lipper.

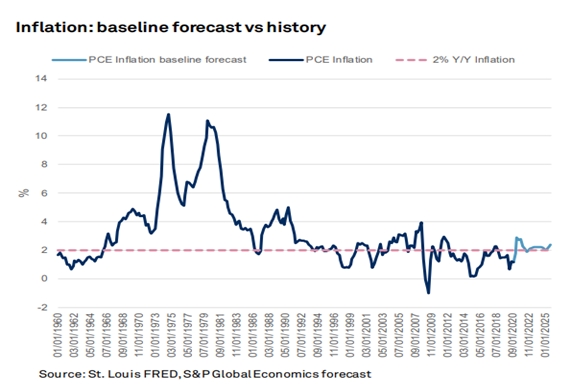

That shift in leveraged finance investor sentiment comes as yields on 10-year U.S. Treasurys remain well above levels throughout much of 2020. And even though by April 23 they had dipped 16 basis points from the start of April, they were still up 65 bps from year-end 2020. As well, after much talk of inflation following the COVID shutdown, when the trailing-12-month consumer price index was near zero, that figure spiked to 2.6% at the end of March, the highest for the metric since June 2018.

Despite the recent inflation number, S&P Global U.S. Chief Economist Beth Ann Bovino says long-term inflation expectations should remain anchored, giving the Fed reason to stay on the sidelines.

You can hear Bovino’s complete U.S. economic outlook here — it includes a look at inflation, GDP, the jobs market and more — via LCD’s latest leveraged finance webinar, available free and on-demand.

Read More: US leveraged loan fund assets surge anew as investors eye floating-rate debt