The Path of Least Resistance for PennyMac Financial Looks to Be Lower

During Monday’s Mad Money Lightning Round one caller asked Jim Cramer about PennyMac Financial Services (PFSI) : “I think you’re fine with that one, but it’s no JPMorgan Chase (JPM) or Bank of America (BAC) .”

Let’s check out the charts of PFSI.

In this daily bar chart of PFSI, below, we can see that prices have been trading sideways since October. Notice all the rally failures around $70?

The daily On-Balance-Volume (OBV) has made little upside progress from October and the trading volume increased in the middle of March as prices failed on the upside again.

The Moving Average Convergence Divergence (MACD) oscillator fell below the zero line earlier this month for a new sell signal.

In this weekly Japanese candlestick chart of PFSI, below, we can see several upper shadows above $65 as traders rejected those prices. That many rejections of the area tells me that the path of least resistance is going to be lower.

The weekly OBV line has not made much upside progress and the MACD oscillator has been pointed down since October.

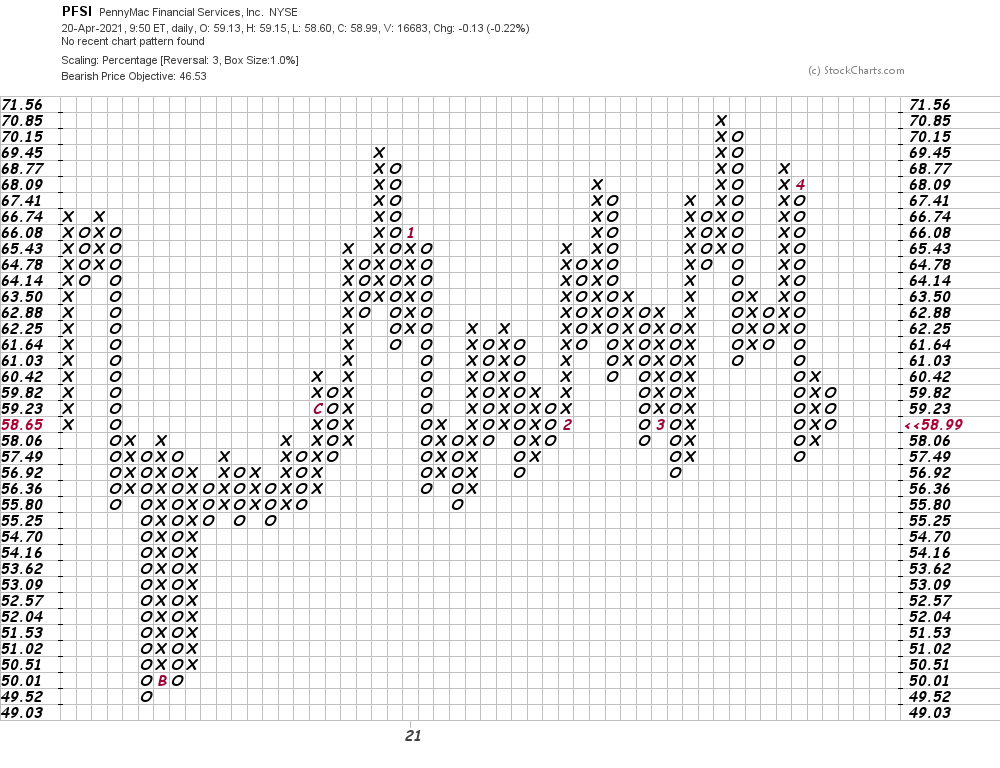

In this daily Point and Figure chart of PFSI, below, we can see that the software is projecting a potential downside price target in the $47-$46 area.

Bottom line strategy: I think the charts and indicators of PFSI suggest lower prices in the weeks ahead. Avoid the long side.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

Read More: The Path of Least Resistance for PennyMac Financial Looks to Be Lower