Collective CARICOM voice for recovery at IMF-World Bank meetings

(MENAFN – Caribbean News Global)

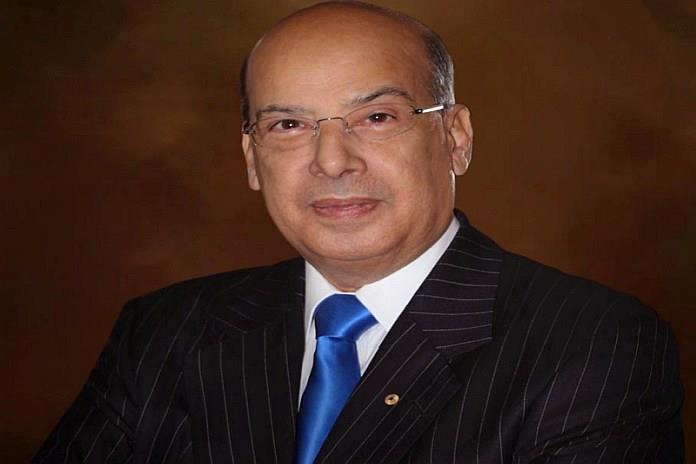

Sir Ronald Sanders is Ambassador of Antigua and Barbuda to the United States and the Organisation of American States. He is also a Senior Fellow at the Institute of Commonwealth Studies at the University of London and at Massey College in the University of Toronto.

By Sir Ronald Sanders

The response by policymakers of the International Financial Institutions (IFIs) to the depth of COVID-19’s effects on Caribbean economies needs to be urgently reviewed, particularly regarding debt.

An unduly optimistic assessment of the extent of damage to economies and an overly confident expectation of how long the effects will last, have resulted in inadequate instruments to help Caribbean countries get out of the hole into which they have been sunk through no fault of their own. Caribbean countries did not create the pandemic and they have been among the most successful in containing it at great cost to their Treasuries.

The staff of the International Monetary Fund (IMF) and World Bank Group (WBG) and the directors on the boards, representing CARICOM countries, deserve credit for advancing the region’s interests. The inadequacy of the IFIs response is not their fault; it is entirely due to board directors of some larger countries who remain stuck to mistaken policy positions whose failures have enlarged the harmful effects of the pandemic.

One of these continuing unhelpful policy positions is the application of per capita income as a criterion to deny high-income Caribbean countries access to concessionary loans, even though these countries are subject to the same vulnerabilities as lower-income countries.

Something of a breakthrough might have occurred. The World Bank board has approved the preparation of loan documents of $100 million each for The Bahamas and Barbados – two of the countries with the highest per capita incomes in CARICOM – ‘due to their heavy reliance on tourism’. This is an admission that the board of the bank has accepted vulnerability as a criterion, that is superior to high income, as a qualification for concessionary loans. It is to be assumed, therefore, that, if these loans are approved by the board in the coming weeks, this criterion can now be applied to other high-income CARICOM countries such as Antigua and Barbuda and St Kitts-Nevis. CARICOM finance ministers at the Spring meetings of the bank and fund should raise this issue collectively.

Doing so, is especially relevant since countries that might have been ‘high income’, according to IMF/WBG measurements, in 2019, are certainly not so today. High unemployment, resulting from the pandemic, has shaved as much as 30 percent from per capita income in some countries and is likely to reduce it even more as unemployment increases and poverty expands.

Amid all this, the IFIs response to high and crippling debt in many CARICOM countries that has spiralled because of the COVID-19 pandemic, has increased their debt service burdens. While the Bank and Fund have explicitly stated that debt levels were, for some, more than 100 percent of GDP prior to the pandemic, the debt instruments that they have provided are burdensome.

As an example, the IMF’s Debt Service Suspension Initiative is only temporary. It is also applicable only to the poorest countries. Therefore only 5 CARICOM countries qualified. The initiative is supposedly to help them cope with the economic and fiscal constraints caused by the COVID-19 crisis. But it gives only a one-year grace with repayment having to be made over five years. Clearly, there will be an increase in the debt service burdens of these countries.

The duration of the pandemic’s effects on CARICOM economies and its severe impact, will be longer than anticipated. Countries, such as Guyana and Suriname, with their oil and gas resources will be better placed, but post-COVID, many CARICOM countries will have much-reduced economies, high debt, diminished…

Read More: Collective CARICOM voice for recovery at IMF-World Bank meetings