Economist Rodney Dickens sees sharply rising interest rates as vaccines allow a

By Rodney Dickens

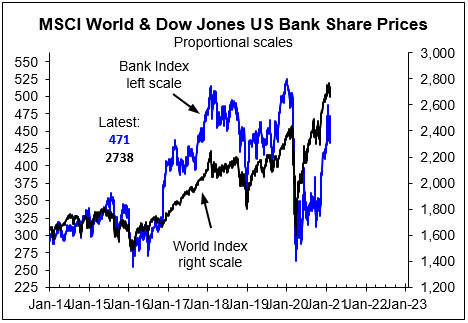

Contrary to the huge surge in business failures and personal bankruptcies that was expected globally as a result of Covid-19, rescue packages have offset the fallout – to the extent in some countries that business failures and personal bankruptcies have fallen below pre-Covid-19 levels. Reflecting this, US bank share prices – a gauge of the market’s assessment of the likelihood of US failures – have belatedly followed the surge in global share prices.

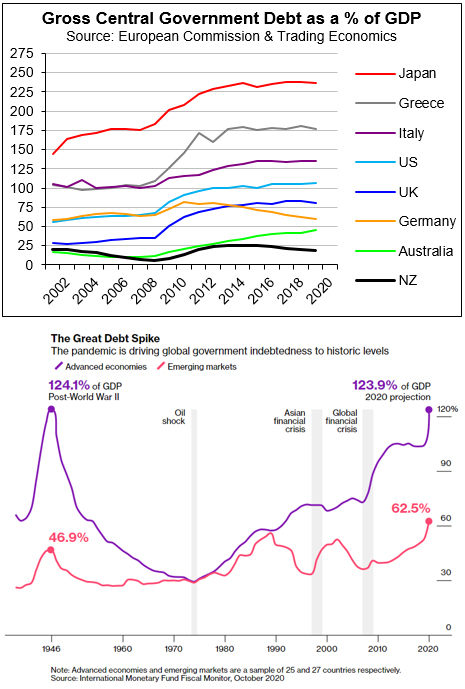

Massive actions by central banks and governments and super-low interest rates have saved the world from a financial crisis, but in doing so have increased the likelihood of a future crisis. The surge in global debt is fine while interest rates remain low, but as global GDP recovers from Covid-19, interest rates in most countries will increase. A W-shaped path is quite possible, but it is much too early to relax about global threats

Rescue packages have offset the Covid-19 fallout and to the extent that in some countries, business and personal failures have fallen

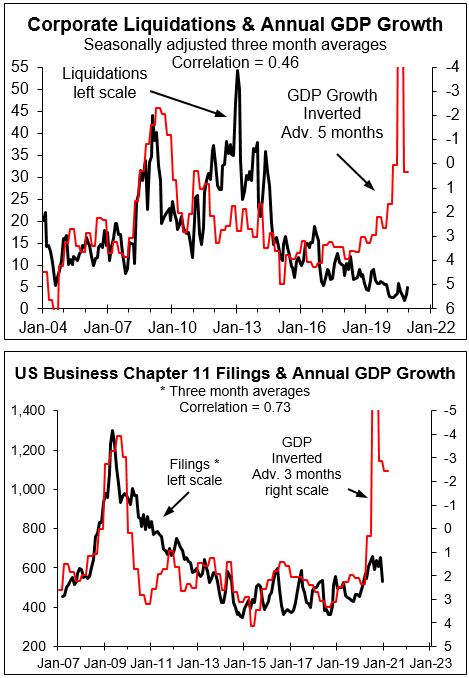

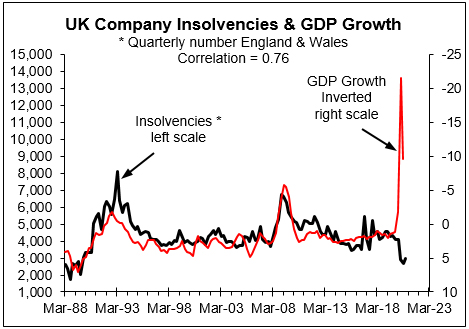

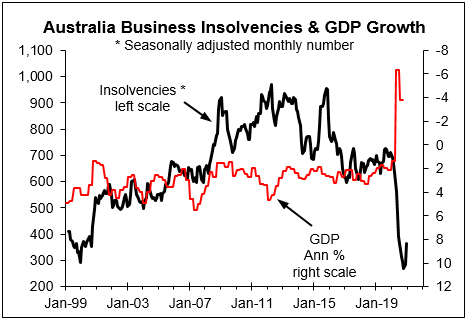

The four chart that follow are repeated from the June 2020 Briefing that looked at the links between GDP growth and business failures for NZ, the US, the UK and Australia. The correlations in the charts are the pre-Covid-19 ones, but for all four cases they will have fallen as a result of the Covid-19 recessions not resulting in a surge in the numbers of failures. In the UK and Australia, the rescue packages have been so effective the numbers of business insolvencies have fallen. The link in the adjacent chart wasn’t at all close in Australia pre-Covid-19 (top right chart).

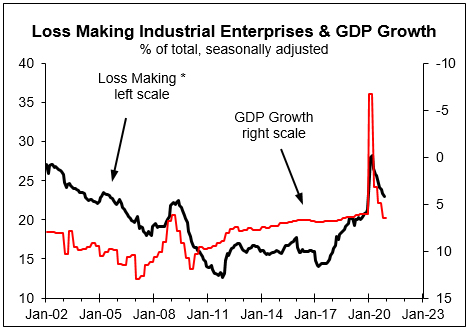

However, in China the Covid-19 recession did result in a spike in the per cent of industrial enterprise that lost money, while the recover in GDP has resulted in a fall in the percentage (next chart). To the extent the rescue packages resulted in fewer failures in some of the countries than would have been the case if it wasn’t for Covid-19, there could be a catchup in the number of failures as the rescue measures are taken away because the measures have kept some firms solvent when they probably shouldn’t have.

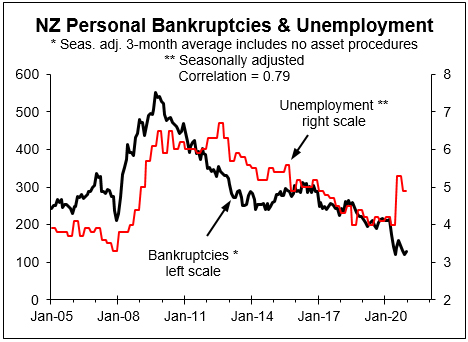

It is even more the case with personal bankruptcies and insolvencies in that rather than increasing as a result of rising unemployment rates, they have fallen as a result of the massive rescue efforts (see the next four charts; the correlations haven’t been updated).

Reflecting fading concern about fallout from business failures and bankruptcies, the US bank share price index has surged since late-2020 (next chart).

The experience with busines failures and personal bankruptcies has been dramatically different to what was generally expected after the first global wave of Covid-19. This link is to a video that painted a dire outlook for US failures and bankruptcies; it even suggested rescue efforts probably wouldn’t stop a surge. The surge in US bank share prices since November is an indication of when views started to change on how much Covid-19 would cause failures.

Super low interest rates and aggressive actions by central banks and governments to the rescue, but it has come at a massive cost that poses a huge threat to the future

High debt levels were a concern in the big countries even before Covid-19 (the first chart below is only updated to calendar 2019). Global debt levels surged last year (second chart below and link that follows to the article titled “The Covid-19 Pandemic Has Added $19.5 Trillion to Global Debt”). Global debt as a % of GDP is approaching post WWII highs for developed countries and has exceeded it for emerging ones.

Source: https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

Super-low interest rates have come to the rescue so the cost to governments of the new debt is extremely low and negative in the case of Germany, while older debt that is maturing is being replaced by lower-cost new debt. This is keeping the cost of…

Read More: Economist Rodney Dickens sees sharply rising interest rates as vaccines allow a