Child Tax Credit Adds New Urgency to Debate on Government Benefit Payment Systems

Trillions of dollars of aid have been sent to U.S. adults since the start of the coronavirus pandemic in the form of stimulus checks and unemployment benefits. That’s put a strain on the often outdated systems that federal governments and states use to disburse money, especially when it comes to unbanked and underbanked Americans.

And now those systems face a new challenge: the child tax credit that’s set to send funds to the families of millions of children in July. While the Biden administration has estimated that 80 percent of eligible households will get that aid directly in their bank account, that still leaves about 1 in 5 who will need to find other methods, such as paper checks or prepaid government benefit cards, to receive the money.

When bank executives appear before the Senate Banking Committee on Wednesday and the House Financial Services Committee on Thursday, Democratic lawmakers are expected to ask about the ways banks have helped disburse money throughout the pandemic, and the issues they’ve had in getting those payments to the right people in a timely manner, according to Senate and House aides.

At the core of the issue is how to get benefits to the unbanked — the people who don’t have access to traditional bank accounts, and who might have issues receiving their stimulus checks and other benefits directly deposited. Research has shown that “unbanked” populations are disproportionately minorities, and are among some of the most vulnerable consumers who need government aid payments to reach their accounts.

From the start of the pandemic, economic stimulus efforts have struggled to reach those Americans who don’t have their direct deposit bank information on file with the Internal Revenue Service, and who don’t get those funds deposited directly into their bank accounts.

Patchy state-controlled unemployment systems have also resulted in inconsistent results for getting jobless benefits across the country. In some states like California, for example, consumers can only get their jobless benefits through prepaid debit cards, which have been plagued by fraud and security issues.

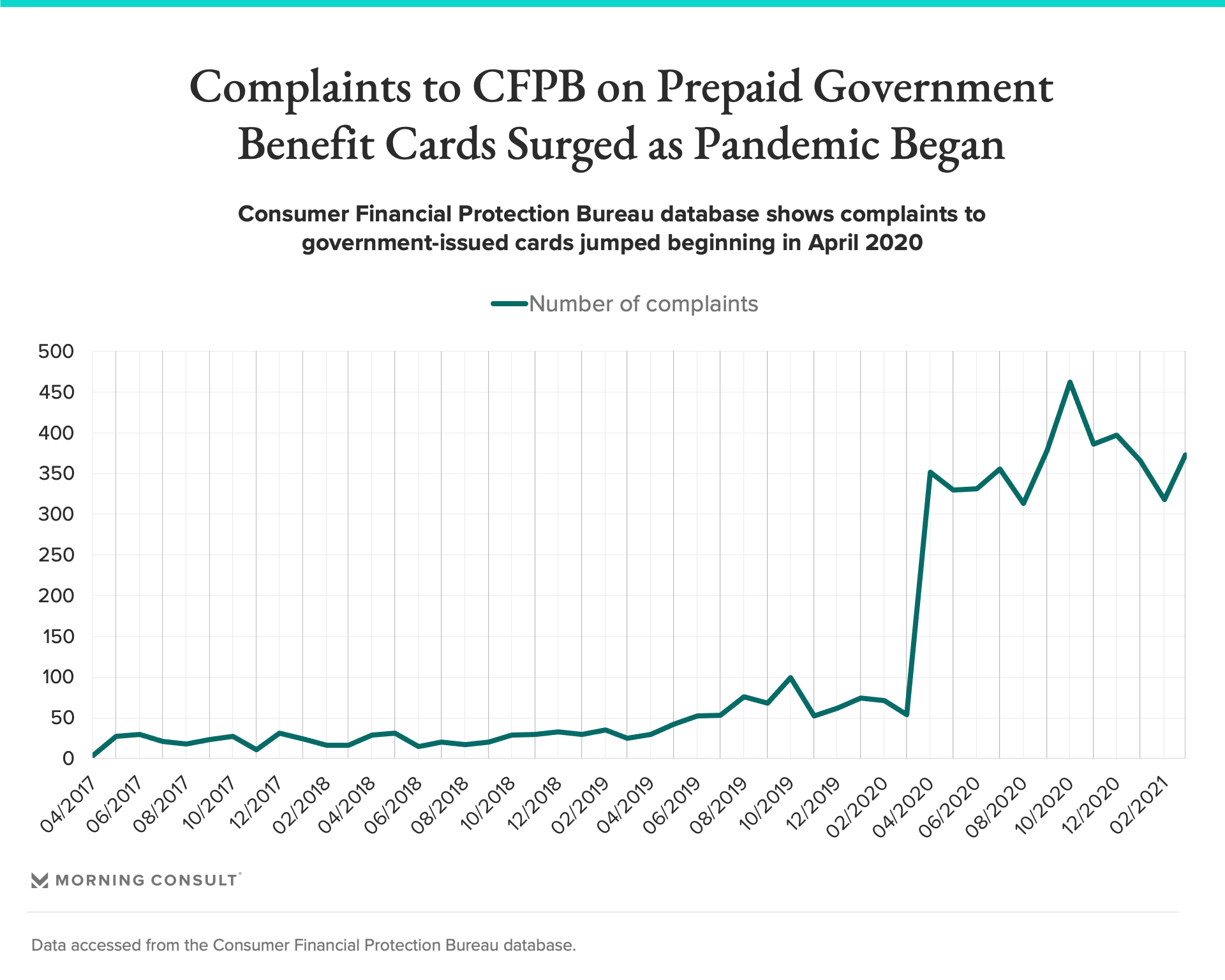

Methods like prepaid benefit cards and paper checks are supposed to help those consumers avoid overdraft fees and allow them to immediately get access to government help. Yet complaints about cards that disburse these benefits, which are used throughout the country — especially for people who don’t have a bank account — rose substantially during the pandemic, according to Consumer Financial Protection Bureau data.

Some of the top complaints are from users that have trouble activating or registering the card and the card company not resolving disputes.

To remedy the issue, progressive lawmakers have argued for a public banking option that would offer free and low-cost accounts to all Americans.

Efforts on this front haven’t gone far yet; Reps. Alexandria Ocasio-Cortez (D-N.Y.) and Rashida Tlaib (D-Mich.) introduced a public banking bill (H.R. 8721) last year that never made it out of committee. The offices of Ocasio-Cortez and Tlaib didn’t respond to a request for comment on whether they planned to revive the bill this session.

The idea of public banking also faces industry opposition: If consumers have the option of going to a public bank to make deposits, banks wouldn’t have that money to make loans or conduct their business the way they do now, banks argue.

“The way that our banking system works is banks get deposits, those deposits…

Read More: Child Tax Credit Adds New Urgency to Debate on Government Benefit Payment Systems