Intesa, UniCredit Head for Reckoning as Covid Loan Holidays End

Banks in Europe’s vulnerable south are about to find out the true scale of the damage to their loan books from the pandemic’s economic turmoil.

Hundreds of thousands of companies and households in nations including Italy and Portugal are resuming loan interest payments that were frozen when lock-downs threatened their livelihoods. Many borrowers from hard-hit sectors like tourism are consequently at greater risk of default, according to Fitch Ratings Inc.

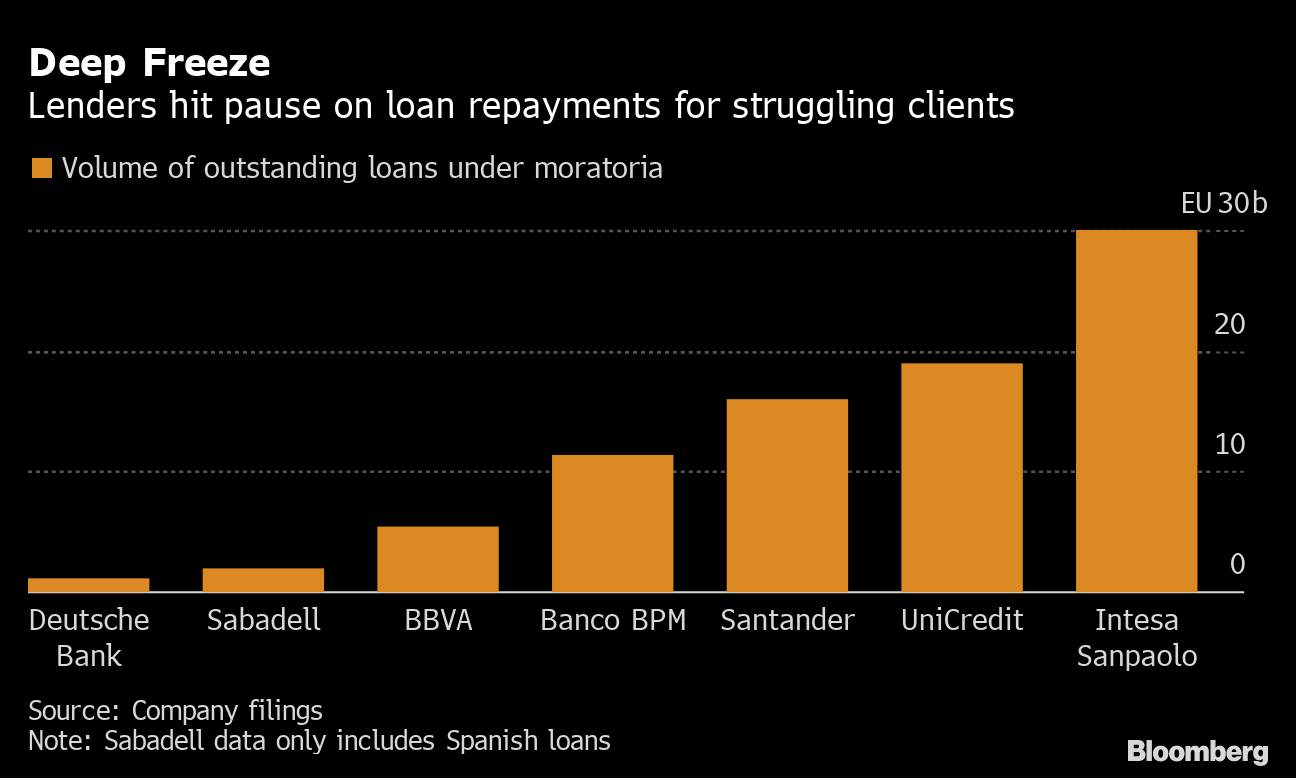

Italian lenders Intesa Sanpaolo SpA and UniCredit SpA have some of the biggest piles of loans with suspended payments. Regulators have repeatedly warned that banks are not taking the oncoming rise in bankruptcies seriously enough amid broadening optimism over the vaccine-driven recovery.

Deep Freeze

Lenders hit pause on loan repayments for struggling clients

Source: Company filings

Credit quality is particularly uncertain in countries including Cyprus, Italy and Portugal, Bernhard Held, a senior credit officer at Moody’s Investors Service said in a May 11 report. “The remaining loans benefiting from moratoria will be the main pockets of potential credit deterioration.”

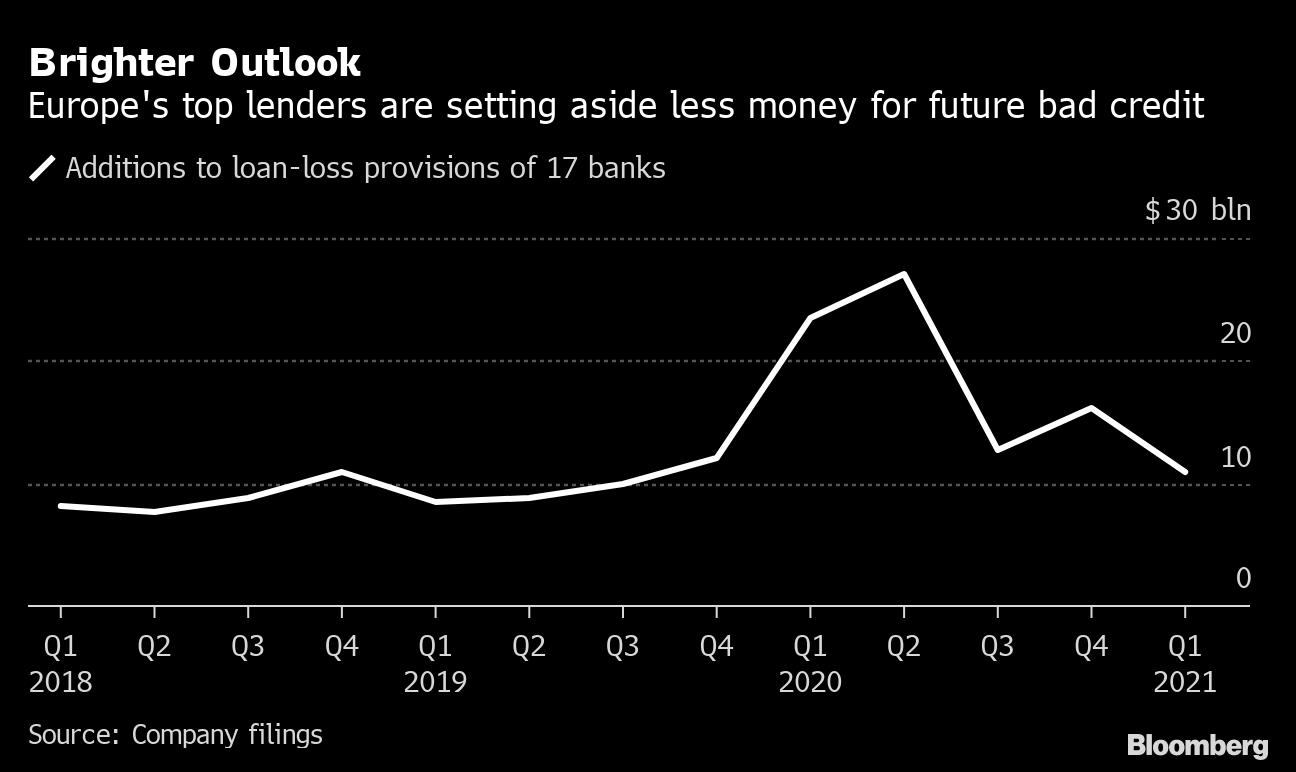

Lenders across the continent posted an almost clean-sweep of above-expectation earnings last quarter, with executives striking a much more optimistic tone than regulators about the need to put cash aside for future troubled credit. Those lower provisions boosted profit figures, and the outlook for dividend payments to investors.

Read More: Europe’s Banks Are No Longer as Afraid of Economic Meltdown

Borrowers from Germany and the Nordics took less recourse to loan suspensions and most of them have already expired. That means that whereas northern European countries have mostly dealt with the hidden risks from loan moratoria, the reckoning is still to come further south.

“I expect a deterioration across the whole credit portfolio, even if loans don’t necessarily become non-performing,” Marco Giorgino, a professor of finance and risk management at MIP Politecnico di Milano, said in an interview.

Brighter Outlook

Europe’s top lenders are setting aside less money for future bad credit

Source: Company filings

Second quarter results will bring evidence of how well southern European banks have provisioned, with a large portion of their remaining moratoria set to expire. UniCredit said that it will see 16.2 billion euros ($19.8 billion) out of a total 18.9 billion euros of frozen loans restart payments in that period. For Santander, it’s about 7 billion euros of a remaining 16 billion euros of deferred loans.

Borrowers from sectors most impacted by the pandemic, such as hospitality, education and entertainment, have made greater use of payment holidays, according to the European Banking Authority.

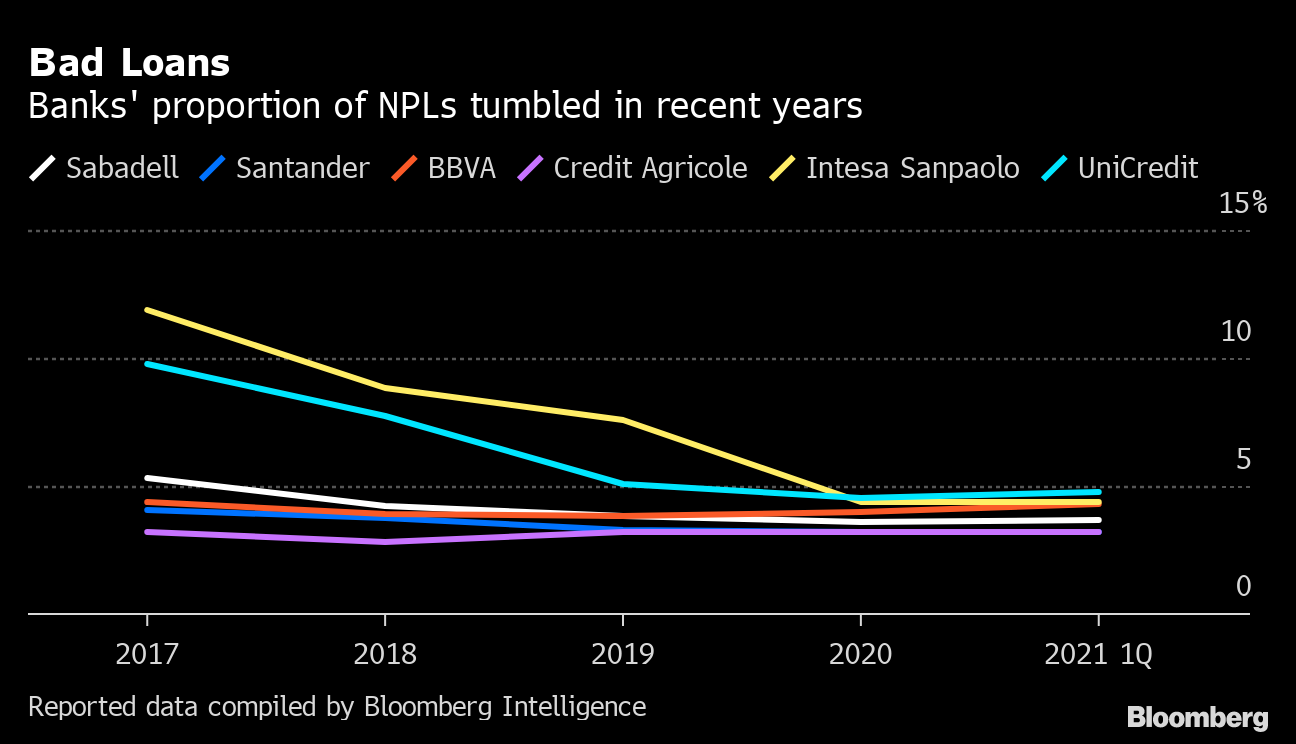

A renewed increase of bad loans may undo years of post-financial crisis clean-up, when regulators pushed lenders to restructure and dispose of non-performing credit.

Bad Loans

Banks’ proportion of NPLs tumbled in recent years

Reported data compiled by Bloomberg Intelligence

Still, most banks are signaling that they’re relaxed about the potential impact on asset quality of a…

Read More: Intesa, UniCredit Head for Reckoning as Covid Loan Holidays End