Wave Payroll Review: Cost, Features, Alternatives

Wave Payroll is an easy-to-use platform that works in tandem with Wave’s free accounting, invoicing and receipt capture software — giving small-business owners a complete solution for managing their finances.

Although you have to pay to use it, Wave Payroll works in tandem with all of Wave’s free products, providing you with a one-stop shop for managing all of your business’s finances. Here’s what you need to know to determine if Wave Payroll might be a good fit for your business.

Wave Payroll: How it works

Wave Payroll is a cloud-based payroll service, meaning your information is stored on Wave’s servers and transferred to your platform via the cloud. When you sign up for Wave Payroll you’ll be able to log into your account via the Wave website on any internet-enabled device. If you’re logging in for the first time, here are the steps you need to take to set up your account and start processing payroll.

Setup

When you sign into your Wave Payroll account for the first time, you’ll be prompted to provide a variety of necessary information to begin processing payroll. You’ll be asked for your employer identification number (EIN), your state identifier (EIN but at the state level), business details (address, entity type, description of products/services), the information of your company signatory, tax information and employee information, including bank account info for direct deposits.

If you are migrating over from another payroll platform, Wave also recommends having your payroll history on hand to ensure the accuracy of your tax reporting moving forward.

Source: Wave Payroll

Dashboard

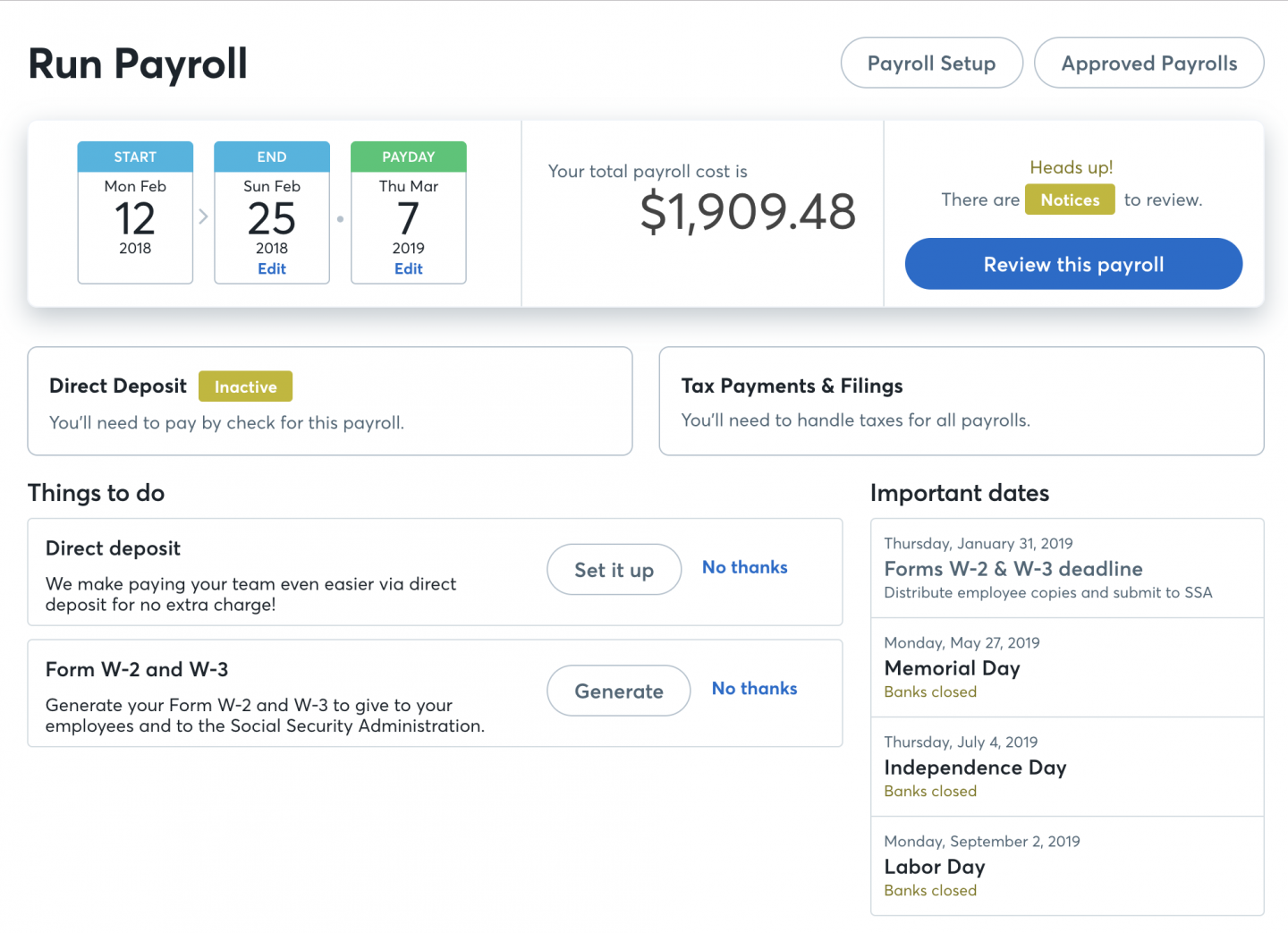

Once you enter in all the necessary information, you will be directed to your payroll dashboard. This is your home base for reviewing, editing and approving payroll runs. There’s one important thing you need to do here before you can start processing payroll: Set up your payroll schedule. Wave Payroll allows for payroll to be run on weekly, bi-weekly, bi-monthly (twice a month) and monthly.

Note that you must log in to your dashboard and approve each payroll run three days prior to the intended payday in order for payroll to be processed on time. Make sure to set your payroll schedule so that the timeframe for approving a payroll comes after the pay period is done. That way, you can approve the payroll run with all employee hours, bonuses and deductions accurately accounted for.

Run payroll

Wave Payroll will send you email reminders to help you remember to run payroll before your deadline. When you’re ready to run payroll, click “Review” on your dashboard.

You’ll be guided to a screen where you can see a list of all your employees, what they’re owed for the pay period, their tax deductions, bonuses and more. If anything looks off, you can navigate to that employee’s profile and make adjustments in the “Benefits and Deductions” tab.

If all looks good, select the “Approve” button to run payroll. If you realize you made a mistake after clicking “Approve,” simply click “Delete” to remove the payroll from pre-approval. Once your payroll is approved, you can view it under the “Approved Payrolls” tab in your dashboard. From here you can also view and download individual employee pay stubs. Approved payrolls will be processed in accordance with your payroll schedule.

Wave Payroll offers two payment delivery options: Direct deposit or self-printing checks. Wave offers check printing services through Check Print. You can opt to print checks for certain employees when you run payroll. Note that you must purchase your own printer-friendly checks, also known as “laser” or “sheet-fed” checks.

For paying contractors, Wave Payroll has a slightly different system. You first must enter them into the payroll system under “Vendors” in the “Purchases” tab of your dashboard. Be sure to mark them as a “1099-MISC contractor.” This will allow Wave to generate the 1099-MISC form at the end of the…

Read More: Wave Payroll Review: Cost, Features, Alternatives