Global i-banks post record revenues, ROE in 2020

Sector revenues at the 12 leading global investment banks rose to their highest level in more than a decade in 2020, driven by capital market volatility triggered by COVID-19, according to Coalition Greenwich, an S&P Global Inc. research company.

The revenue surge pushed the aggregated return on equity at the tracked banks into double digits for the first time since 2016. The ROE rose to a five-year high of 13.2% in 2020, from 7.5% a year ago.

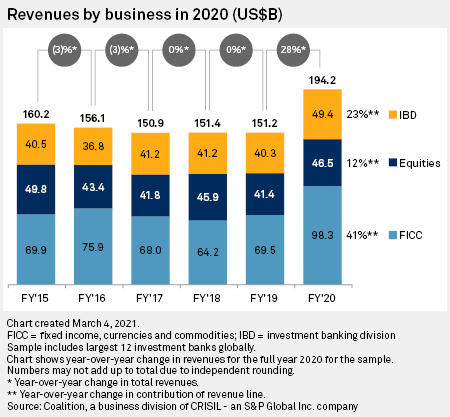

Total investment bank revenues at the 12 major U.S. and European institutions in the sample increased 28% year over year to $194.2 billion in 2020, Coalition Greenwich‘s Investment Banking Index shows. The index sample includes Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley, Barclays PLC, BNP Paribas SA, Credit Suisse Group AG, Deutsche Bank AG, HSBC Holdings PLC, Société Générale SA and UBS Group AG.

FICC slowdown

Revenues generated from fixed-income, currencies and commodities trading were the main growth driver for total investment bank revenues in 2020. FICC revenues rose 41% year over year to $98.3 billion in 2020, with all products in that business segment benefitting from heightened market volatility and increased client activity, according to Coalition Greenwich.

Macro products booked marked increases in the first half of 2020, including a 65% year-over-year surge in emerging markets macro and an 87% jump in rates revenues in the period. FICC revenue growth in the second half of the year was bolstered by a 98% jump in commodities revenues and a 55% increase in credit product revenues, the data shows.

As expected, FICC revenue growth slowed in the fourth quarter as volatility eased, Youssef Intabli, a research director at the corporate and investment banking team of Coalition Greenwich, said in a written comment. FICC revenues in the first quarter of 2021 are developing similarly to those in the previous three months, driven mainly by credit amid a slowdown in foreign exchange and macro trading, Intabli said.

Positive outlook for equities

Equities trading revenues marked the smallest year-over-year increase, of 12% to $46.5 billion, in 2020 due to weaker performance in the prime services business. The slowdown was due to margin pressure and dividend losses booked in the first half of the year. Equity derivatives, on the other hand, reached their highest volumes in a decade due to a surge in client activity, especially in flow derivatives, according to Coalition Greenwich.

In the first quarter of 2021 equities revenues are likely to increase year over year, driven by cash equities volumes, especially in the Americas and Asia-Pacific, and with the absence of losses seen in EMEA at the same time last year, Intabli said. French banks in particular suffered large losses in their auto-callable structured derivatives operations as many companies canceled planned dividends after the onset of COVID-19.

Revenues in the investment banking division, or IBD, business — including deal advisory, debt and equity issuance and origination — rose 23% year over year to $49.4 billion in 2020. The strong performance of the debt and equity capital market segments offset a slowdown in M&A where activity dropped due to lower industry-wide volumes.

In the fourth quarter, IBD revenues grew 36% year over year. This was mainly driven by a boom in IPOs of special purpose acquisition companies, which caused an equity capital market issuance jump of more than 100% in the quarter, Intabli said.

Productivity, operating margins jump

Productivity, which Coalition Greenwich measures as revenues divided by revenue-generating front-office headcount, rose to a three-year high across all the main business lines: FICC, IBD and equities. Thanks to the strong revenues and a 1% reduction in headcount, FICC productivity surged 44%. Equities, where headcount fell by 4% year over year, booked a productivity increase of…