Why Should Banking Providers Offer Credit Builder Loans?

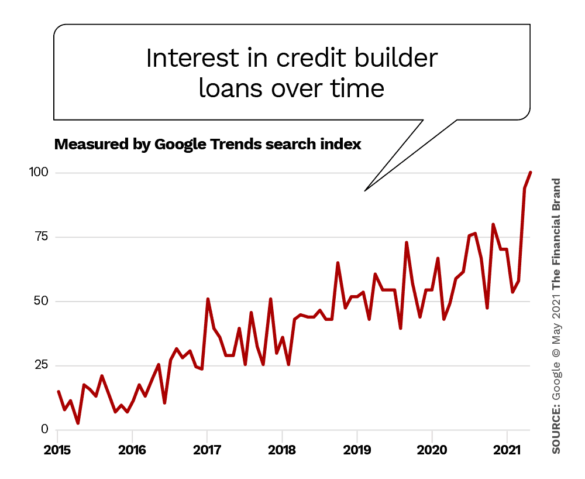

Consumers want to learn more about building their credit scores than ever before. People specifically are looking to dive into credit builder loan programs, often nicknamed the “backwards loan,” as a quick option. Google Trends, which tracks how often a term is searched, found that “credit builder loan” was searched far more often in 2020 than when it was a few years earlier.

Much of that jump likely can be attributed to the economic pressures of the pandemic, but whatever the cause, the change didn’t go unnoticed by the fintech community.

Most banking executives likely know what a credit builder loan (CBL) is: a non-traditional loan where people receive the funds at the end of the agreed term instead of receiving the money upfront. It’s designed to help consumers with no credit history (or credit score) or a low score gain entry into the credit market.

Despite the edge for consumers, most banks or credit unions spend few to no resources advertising these loans. Maybe their institution started the program years ago and now the program just fields a few hundred low-ROI loans every month. Nothing particularly special.

Food for Thought:

Although credit builder loans are fueling boosts in consumers’ credit scores, and there is profit potential in the loans, banks and credit unions aren’t advertising them.

It makes sense that more people are intrigued by credit builder options now — especially younger generations who are told to build their credit, but who also want a low-risk alternative to a credit card, which many young adults view as a too-easy route to debt. Traditionally, banks and credit unions don’t require a hard credit check with CBLs, so there is no minimum credit score requirement.

It’s an effective option. Credit Strong, a fintech owned by Austin Capital Bank, which specializes in credit builder loans, analyzed 50,000 of its customers and found the average account holder with a CBL increased their credit scores by 70 points on average.

For a nation with millions of Americans with no or poor credit score, this could be a notable solution.

( Read More: Rethinking Lending & Credit in a Post-COVID World )

Credit Builder Loans Are Relevant In Today’s Society

Roughly 26 million adults — one in every ten Americans — are “credit invisible,” which means they lack a credit score entirely, according to a 2020 Consumer Financial Protection Bureau (CFPB) study.

In their findings, the CFPB found an additional 19 million Americans had a credit record, but no actual credit score “because their history is too thin.” Even then, of U.S. citizens with credit scores, one in three people have a subprime score (traditionally between a 580 and 669).

The Existing Problem:

Millions of people in U.S. struggle to get a credit score up and running, and there are even more who have difficulty maintaining a healthy credit score. Credit builder loans can help with both.

The CFPB found an additional 19 million Americans had a credit record, but no actual credit score “because their history is too thin.” Further, of those citizens with credit scores, one in three have a subprime score (traditionally between a 580 and 669).

In their report, CreditStrong highlights the benefits of a CBL for individuals with non-existent or subprime credit scores. One is that the average account holder with a low FICO score increased their score by more than 25 points in three months. After nine months, they improved by 40 points. On top of this, account holders with no credit score paying their loan payments on time reported earned credit scores between 630 and 650 after the first year.

Read More:

REGISTER FOR THIS FREE WEBINAR

Personalized Communications in Financial Services

Join Messagepoint to explore the role customer communications play in CX and how to effectively overcome those barriers to success with personalized communications.

Wednesday, June 2nd at 2pm (ET)

What Are the…

Read More: Why Should Banking Providers Offer Credit Builder Loans?