Bank of England expected to predict faster recovery as economy strengthens –

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

The Bank of England sets UK interest rates at noon today, against the backdrop of an economic recovery as the country slowly emerges from lockdown and more people are vaccinated.

Private sector growth is the fastest in years, mortgage lending is at a record, and economists are predicting the biggest bounce in GDP since the 1940s.

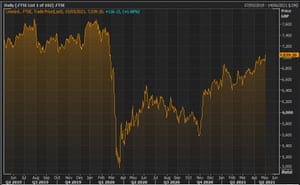

Investors are also upbeat. The FTSE 100 share index hit its highest level in over a year yesterday, with mining giants, oil companies and banks among the risers — all companies who benefit from a global rebound.

So with the economic picture brightening, the BoE is expected to raise its growth forecasts today, in its latest Monetary Policy Report (also released at noon).

Elsa Lignos of RBC predicts that the Bank will predict a smaller spike in unemployment this year:

Significantly, the extension of the government’s furlough scheme, which was announced at the budget, is likely to see the MPC lower its estimate of where it expects unemployment to peak once support is withdraw.

This optimism certainly isn’t expected to trigger an interest rate rise from their current record low of 0.1%.

But…the Monetary Policy Committee will be pondering when it should slow, or taper, its £895bn asset purchase stimulus programme, which is buying up around £4.4bn of government bonds each week.

Any hawkish signals about that could also sent the pound higher (it’s currently trading at $1.39).

Joumanna Bercetche 🇱🇧

(@CNBCJou)Bank of England today. Reminder that a mechanical tapering is *already* what the MPC have guided towards

See below from the Feb MPR where Ramsden says “we do need to slow the pace somewhat at some point” so they don’t go over the £150bn envelope pic.twitter.com/CAbvsxnJjo

Shamik Dhar, chief economist at BNY Mellon Investment Management, says the prospects for the UK economy “look bright”.

Thanks to an impressive vaccine rollout, the economy looks set to bounce back strongly in the second half, probably at double digit annualized growth rates, returning overall activity to pre-crisis levels this year. Inflationary pressures might build, but will probably be contained by a strong supply response in those industries that have been locked down. The Bank of England (BoE) remains a long way off tightening monetary policy, but could be one of the first central banks to signal it’s thinking about it, possibly in early 2022.

This said, the BoE is thinking about switching the traditional sequencing of the policy tightening, with hikes in the policy rate possibly coming before a shrinkage in the balance sheet, and is expected to provide guidance on this issue in the next policy meetings. We anticipate that much of the fiscal deficit will correct automatically as private sector economic activity picks up strongly, but the Chancellor may need to raise taxes modestly further from here. Longer term, the public debt burden will fall so long as the yield on gilts remains lower than the nominal growth rate of the economy.

But the economy won’t return to its pre-Covid state, of course, Dhar adds:

“The economy will return to pre-crisis levels of economic activity quickly, and possibly recover the pre-crisis trend level next year. But the composition of the UK economy has probably changed permanently thanks to the pandemic. While we will see a strong bounce back in ‘close contact’ industries, such as hospitality and travel, this year and next, they may never recover…

Read More: Bank of England expected to predict faster recovery as economy strengthens –