The Banking Model of the Future: ‘Neo+Traditional’ Hybrids

While big banks have typically used technology and scale to crush smaller competitors, the underdogs are starting to make a comeback.

In fact, one report now says some smaller banks are adopting technology at a higher rate than big institutions, and they’re using it to find new competitive advantages.

But there’s a catch. So far only a handful of institutions are following this path out of the many thousands of traditional community and regional banking providers. Still, it confirms the competitive potential existing in many smaller institutions.

Kroll Bond Rating Agency (KBRA) looked at a group of what it calls “neo/hybrid” banks and found many are having success by rapidly integrating technology with their traditional operations.

Turning Point:

This new hybrid model can help smaller institutions turn the tables and leverage both technology and relationships to regain some of the market share they’ve lost.

A ‘Paradigm Shift’ in Technology Adoption

KBRA studied a group of financial institutions it calls the “KBRA Neo/Hybrid Bank Group” to see how they approached the use of technology within the areas of lending, deposits and processing. These institutions were notable for the differentiation in how they approached technology compared to their peers. Among the group were The Bancorp Bank, Cross River Bank, MetaBank and Axos Bank.

In recent years, consolidation in the banking industry has only increased the competition between megabanks with scale and smaller institutions that lack it. While fintechs and big players roll out shiny apps and new digital initiatives, smaller institutions have often found technology to be a complex and expensive hurdle to climb, according to the FDIC Community Banking Study.

However, since the start of the pandemic, there has been a significant paradigm shift in technology and investment rates from larger to smaller banks, KRBA notes. More community and midsize institutions are now finally taking greater advantage of lower-cost digital platforms to breach previous scale limitations and gain new efficiencies. One primary trend KBRA found is that smaller banks are taking a closer look at lower-cost platforms to redefine product delivery.

It’s a long-overdue move for many, but these financial institutions now realize they can no longer drag their feet on digitization. While the growth of remote capture, online account opening, and younger consumer behaviors have lessened the need for branches, the trend has only increased since the pandemic. As a result, the pace of branch consolidation has also accelerated. The lockdowns early in the pandemic forced even slow adopters to digital channels, and there’s a large consensus that many of these new patterns will remain.

While big banks benefited the most from this trend, the forced digitization has led other institutions to leap forward years in only a matter of months, adopting new payment apps and other modern technologies. Even well before the pandemic, several small banks made big bets on digital-only initiatives. Some of these are Cross River Bank, NBKC Bank, Quontic Bank, BankMD and Leader Bank.

( Read More: How BaaS Turns Traditional Banks Into Digital Deposit & Loan Machines )

New Model Reduces Expenses and Expedites Deposit Growth

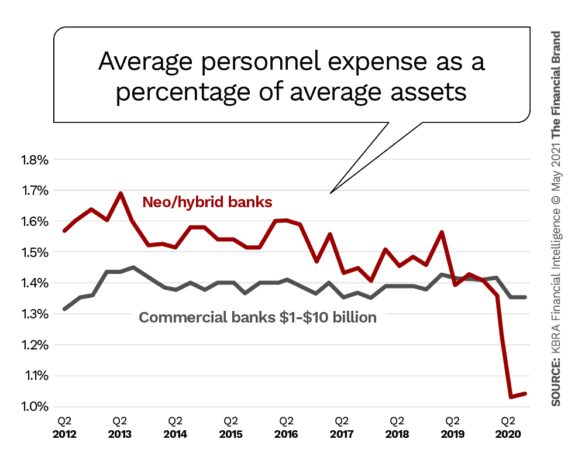

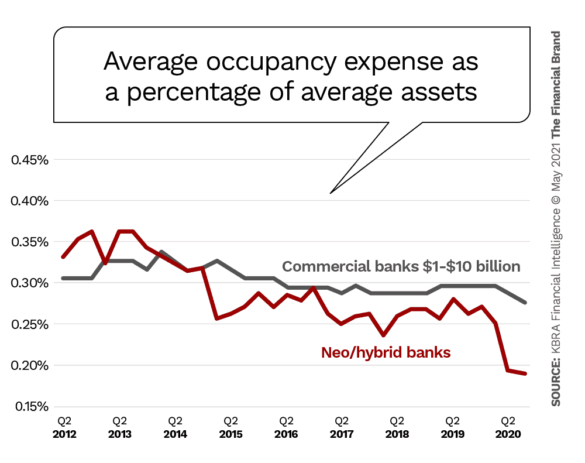

While innovative thinking boosted by new technology enabled these hybrid banks to reinvent themselves and stay relevant, it has also reduced personnel and operating expenses by decreasing reliance on physical branches. KBRA reports that the hybrid bank group has significantly lower average personnel expenses and average occupancy expenses as a percentage of average assets, compared to traditional banks with revenues between $1 billion and $10 billion.

Small financial institutions are not only reducing costs but also finding new revenue opportunities by offering banking-as-a-service,…

Read More: The Banking Model of the Future: ‘Neo+Traditional’ Hybrids