Bank of Korea Lee Sees Faster Growth, Plays Down Rate Hike Odds

Lee Ju-yeo

Photographer: SeongJoon Cho/Bloomberg

Photographer: SeongJoon Cho/Bloomberg

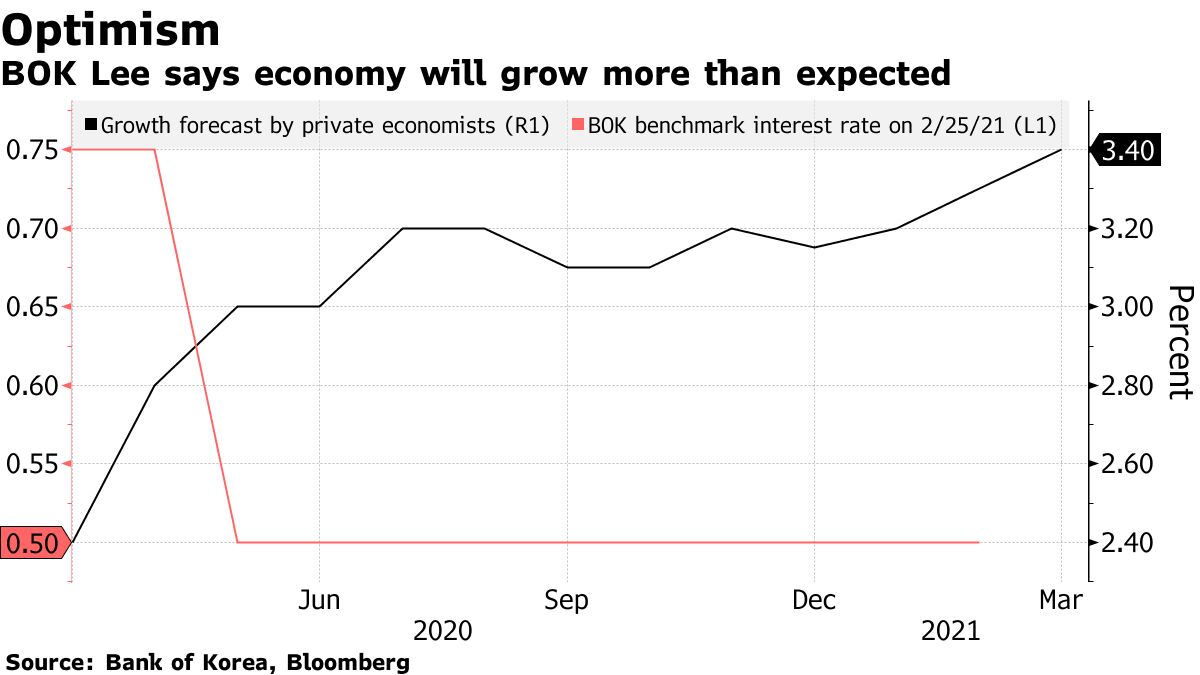

Bank of Korea Governor Lee Ju-yeol said he expects faster inflation and economic growth this year, but dismissed the view that the central bank needs to tighten policy early to tackle rising financial risks.

In comments released Wednesday, Lee pointed to improving exports and investment, along with an extra budget pending parliamentary approval, as factors likely to drive economic growth beyond the BOK’s 3% forecast in February. Lee said inflation will also probably accelerate beyond the bank’s previous 1.3% projection.

The statement was formatted as Lee’s response to questions on the economy and markets, and was released to communicate with central bank watchers before the next policy review in April given the long gap between meetings. Lee’s views echo those of President Moon Jae-in who also projected a “faster and stronger” rebound for the economy.

Moon Sees Stronger Korea Recovery in 2021 Than Earlier Expected

On both the inflation and growth fronts, Lee emphasized there is no urgency to respond by adjusting the bank’s policy stance. Having cut the key rate to a record 0.5% last year, the BOK has repeatedly pledged to keep policy accommodative until the economy stages a sustainable recovery from the pandemic.

“There could be views that the timing for shifting monetary policy could be moved forward” due to an improved outlook and growing concern about financial imbalances, Lee said. “Still, the economy hasn’t recovered to its normal trajectory, and the current situation doesn’t call for a rush to adjust the policy stance.”

Lee said the pace of recovery will hinge on Covid developments, vaccine distribution, as well as the strength of the global semiconductor industry and how U.S.-China trade tensions unfold.

On inflation, Lee said an outburst of pent-up demand as outbreaks subside may temporarily fuel a rise in consumer prices. A sustained pickup is unlikely, though, so it’s not time to worry about inflation risks or to respond with monetary policy.

- Inflation may reach the upper 1% range during the second quarter due to a base effect from an oil-price plunge last year, and then stay within the mid-to-upper 1% range in the second half of the year.

- The amount of outright government bond purchases depends on the pace of yield gains, as well as the drivers behind rises. Managing liquidity after buying is also an important factor. For now, the BOK is able to buy bonds “without particular difficulty.”

- The yield spread between short- and long-term bonds has widened in March at a “faster pace than expected.” The BOK’s monetary stabilization bond issuances can be “flexibly adjusted” as needed to respond to market volatility and any supply-demand mismatches.

- BOK bond purchases aim to stabilize markets, and are different from quantitative easing or operation twist.

- Demand for cryptocurrencies as a settlement tool is expected to fall when central banks issue their own digital currencies. The BOK is planning to test its own in a virtual environment during the second half.

Read More: Bank of Korea Lee Sees Faster Growth, Plays Down Rate Hike Odds