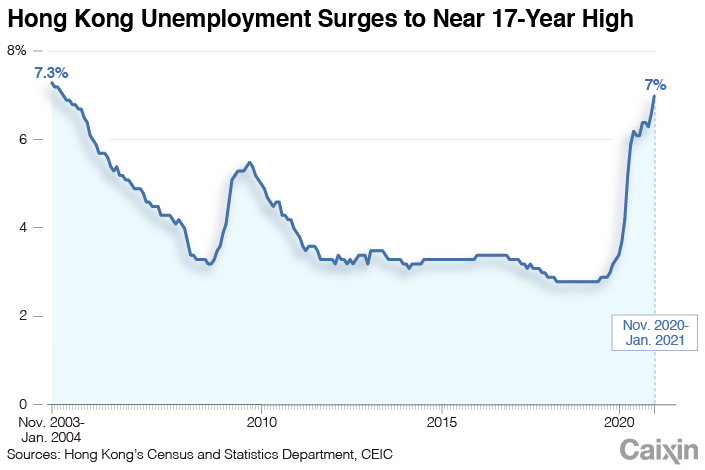

Chart of the Day: Amid Surging Unemployment, Hong Kong Guarantees Cheap Loans

The Hong Kong government plans to offer the unemployed guarantees for low-interest bank loans as part of a package of measures to help cushion the impact of the Covid-19 pandemic, as Financial Secretary Paul Chan warned that the economy will face “significant challenges” in the first half of the year.

Hong Kong’s unemployment rate has more than doubled over the past year as the impact of the coronavirus epidemic devastated the economy which contracted by a record 6.1% in 2020. The official jobless rate stood at 7.0% in the three months to end-January 2021, up from 3.3% in the October-December 2019 period, government data show. That’s the highest since the three months to April 2004, when the rate stood at 7.1%.

The government has rejected calls for temporary unemployment handouts, but is offering an “extra financing option” in the form of a Special 100% Loan Guarantee for Individuals Scheme, Chan said in his budget speech on Wednesday. This will allow the unemployed to take out bank loans of up to six times their average monthly income during their previous employment subject to an HK$80,000 ($10,320) cap. The government will provide guarantees for a total of HK$15 billion. The loans, which residents will need to apply for within six months, will carry an annual interest rate of 1%, compared with the current average bank lending rate of 5%.

Borrowers will only be obliged to repay the interest in the first 12 months, after which the principal and interest can be repaid over a maximum of five years. Those who repay the loans in full on schedule will receive a full refund of the interest paid, according to the scheme.

|

The resurgence of the coronavirus in Hong Kong in the fourth quarter has exacerbated an already severe unemployment in the city which is heavily dependent on consumption and tourism. Joblessness across these sectors, which include retail, accommodation and food services, jumped to 11.3% in the three months to January, more than double the rate in the same period last year, Census and Statistics Department data show.

Read more

In Depth: How a Rugged Covid-19 Recovery Risks More Than 100 Million Jobs

Hong Kong offers limited support for the unemployed and the city’s unions and industry groups had called for a temporary unemployment fund to provide those without a job with a temporary cash allowance for six months. But the government rejected these demands.

Hong Kong’s Secretary for Labour and Welfare, Law Chi-kwong, said in February the government had already introduced a range of measures to create jobs and stabilize the employment market, and provided other types of relief measures and short-term assistance. He said a “temporary” unemployment fund would overlap with these measures and, based on past experience, may not come to an end within a short period of time.

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

You’ve accessed an article available only to subscribers

VIEW OPTIONS

Read More: Chart of the Day: Amid Surging Unemployment, Hong Kong Guarantees Cheap Loans