The State of American Debt Slaves: Q4 2020. Consumer Borrowing in Weirdest

Amid enormous shifts and distortions in consumption and trillions of dollars handed out by the government and the Fed.

By Wolf Richter for WOLF STREET.

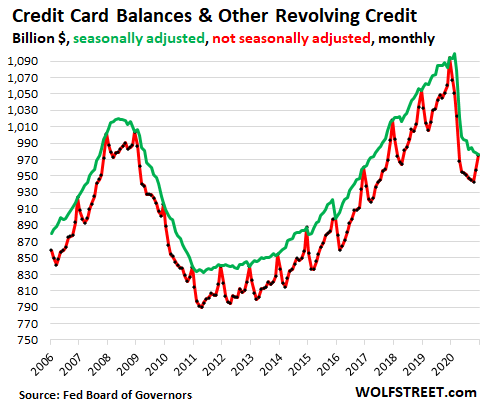

American consumers – those hundreds of millions of mythical creatures whose sole job is to consume more than they make – have paid down their credit cards again. In December, the crucial month for overspending with borrowed money, credit card balances and other revolving credit ticked down 0.3% from the prior month, to $976 billion, seasonally adjusted (green line in the chart below), according to the Federal Reserve Friday afternoon. This was down 10.8% year-over-year, the steepest year-over-year decline ever.

On a not seasonally adjusted basis (red line), credit card balances normally spike in December during the holiday shopping melee. But last December they didn’t spike nearly enough and fell 10.8% from the prior year, also the steepest year-over-year percentage drop, to $976 billion, a balance first reached in the good old days of September 2007.

The seasonally adjusted balances are pegged to the not-seasonally adjusted December balances. That is why in the chart above, the green line (seasonally adjusted) is always way higher than the red line (not seasonally adjusted) except in December when they match. The idea of those big seasonal adjustments is to iron out the big seasonal volatility of credit-card usage.

The 10.8% year-over-year decline beat the prior record decline of October 2020 (-10.3%) and the prior steepest declines ever (-9.9%) in January and February 2010 during the Financial Crisis.

The $600 stimulus payments that started going out at the very end of December are likely not yet reflected in the data but will show up in the January data. And then there will be the next stimulus payments now being worked on in Congress. So the decline in credit card balances is likely not over yet:

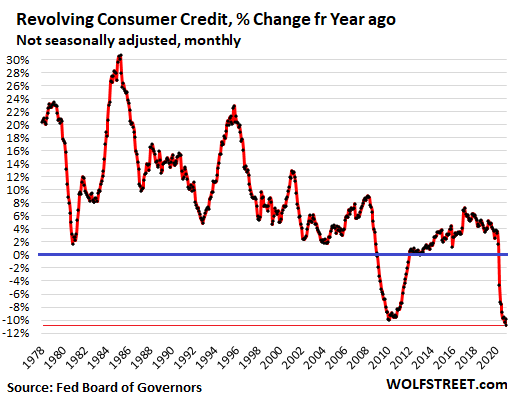

Until the Financial Crisis, there had never been a year-over-year decline in revolving credit balances. That was a new phenomenon, after decades during which Americans had amassed ever more credit card debt, buying things they couldn’t afford and paying breath-taking interest rates for the privilege. And so they did their job and consumed and cranked up the consumer economy.

That scheme blew up during the Financial Crisis, when masses of credit card borrowers defaulted and let banks eat the losses, along with the losses from their defaulted mortgages.

Now we have the second period of year-over-year declines, and it’s the steepest ever, but it’s not caused by defaults, but on one hand by huge amounts of government stimulus money in various forms, and on the other hand, by limits to consumption: Many services – restaurants, bars, sports venues, concerts, hotels, cruises, flights to exotic destinations, etc. – have become partially or totally unavailable.

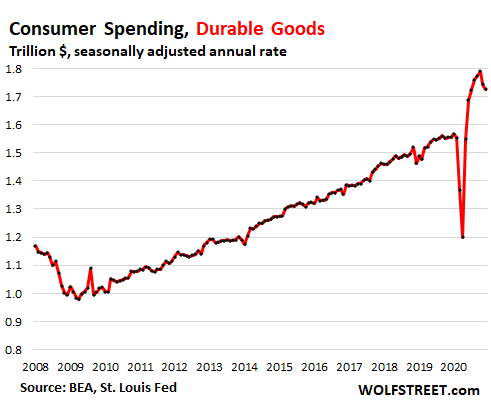

Some of this money that would have been spent on these services was spent on goods, and the amounts of money spent on durable goods in 2020 spiked to records:

And some of the money that would have been spent on services and would have been added to credit card balances, was saved and a portion of these savings were used to pay down credit card debt. This has all become part of the Weirdest Economy Ever.

Auto loans.

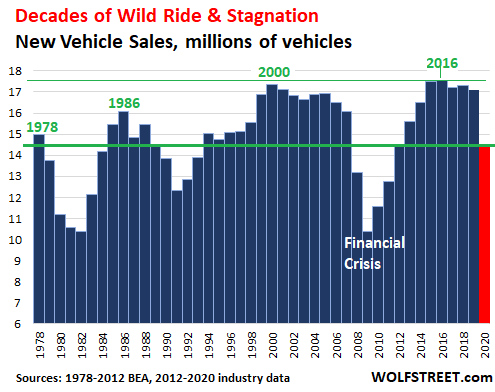

The thing that happened with driving-obsessed Americans in 2020 was a 15% plunge in new vehicle sales, in terms of the number of vehicles sold: Only 14.46 million new vehicles were sold (red column) which took sales back to where they’d been in the 1970s:

And used vehicle retail sales fell 6.25% in 2020, to 19.5 million vehicles, according to estimates by Cox Automotive.

But even as total new and used vehicle volume dropped sharply in 2020, prices spiked by 15% year-over-year in used vehicles during the summer and fall. And consumers with money – the beneficiaries of working from home and the Fed’s money printing – shifted to more expensive new vehicles, particularly…

Read More: The State of American Debt Slaves: Q4 2020. Consumer Borrowing in Weirdest