Work-From-Home Benefits: New WFH Tax Could Subsidize Low-Income, Essential Work

Photographer: Stefan Wermuth/Bloomberg

Photographer: Stefan Wermuth/Bloomberg

Sign up here for our new personal finance newsletter and follow us @Wealth on Twitter.

Choosing to earn a living from home once the pandemic ends is a privilege that you should pay for, according to strategists from Deutsche Bank AG’s research arm.

“Working from home will be part of the ‘new normal’ well after the pandemic has passed,” the strategists led by Luke Templeman wrote in a note. “We argue that remote workers should pay a tax for the privilege.”

The team propose a 5% levy for those who work from home on a regular basis and not because of a government lockdown mandate. Such a measure could raise $48 billion a year in the U.S. and about 16 billion euros ($18.8 billion) in Germany, they say, to fund subsidies for low-income earners and essential workers who are unable to work remotely.

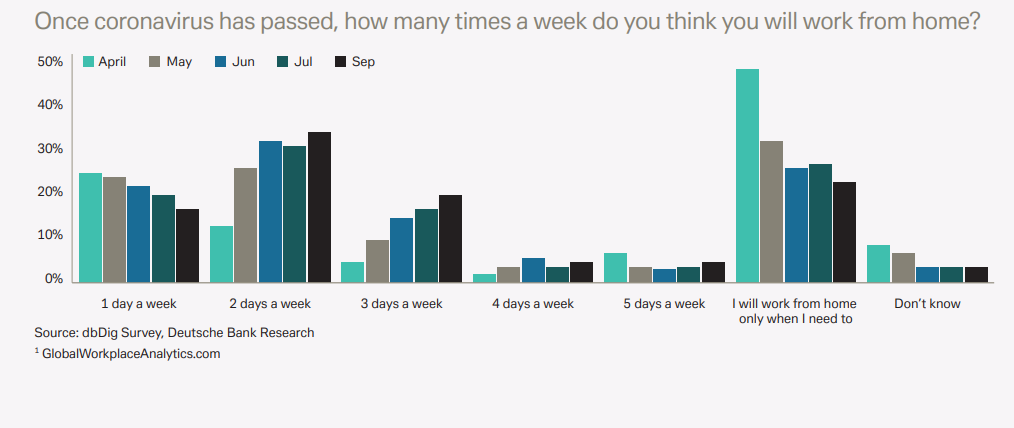

Deutsche Bank Research undertook a survey to examine the major global shift toward remote work that occurred as a result of the Covid-19 pandemic, which may endure as many professionals discover financial, personal and professional benefits of the change. According to the results, more than half of those working remotely want to continue doing so for between two and three days a week even after the health crisis ends. The survey of 800 people was conducted in September.

Working in the comfort of one’s own home saves money on travel, lunch and socializing, according to Deutsche Bank Research, and offers greater job security and flexibility, the strategists said. Yet people who are working remotely are also contributing less to the infrastructure of the economy, potentially extending the slump in national growth, they said.

“That is a big problem for the economy as it has taken decades and centuries to build up the wider business and economic infrastructure that supports face-to-face working,” Templeman said.

The proposed levy would be paid by the employer if they don’t provide their employee with a desk, whereas if the worker decides to stay home based on their own needs, they would be taxed for each day they work remotely, according to Deutsche Bank Research. In the U.S., the strategists calculate, such a tax could pay for a $1,500 grant to the 29 million workers making under $30,000 a year and unable to work from home.

“It does make sense to support the mass of people who have been suddenly displaced by forces outside their control,” Templeman said. “Those who are lucky enough to be in a position to ‘disconnect’ themselves from the face-to-face economy owe it to them.”

Read more: What We Learned From the Work-From-Home Experiment: QuickTake

(Updates with quote in the sixth paragraph)

Read More: Work-From-Home Benefits: New WFH Tax Could Subsidize Low-Income, Essential Work