Understanding The Irrational Fear Of Deflation

Anyone with an undergraduate degree in economics will be well aware of the supposed importance of positive inflation in fostering economic growth and stability. If inflation is too high, so it goes, then this is bad for the economy, but generally speaking it is better to err on the side of higher inflation so as to avoid deflation. The idea being that if prices fall then this will discourage people from buying things in anticipation that prices will fall even further, causing a fall in aggregate demand and a drop in production. This is perhaps the best example of how conventional economic wisdom is completely and utterly backwards.

Deflation Is Always Good, All Else Equal

Declines in the general price level are almost always the result of one or both of the following factors: increased economic output and declining money supply. For any given amount of money in existence, the higher the level of production, the lower the average price level.

Deflation is simply the mechanism by which equilibrium is restored amid the reduced availability of money or increased availability of goods. For instance, the decline in oil prices over recent decades has not been driven by falling demand for oil but by an increase in its supply owing to greater productivity in oil production.

Depending on whether prices are falling as a result of increased output or falling money supply, economists often use terms such as good deflation and bad deflation. These definitions seek to place some causality on falling prices when in actual fact deflation is just a by-product. It is not falling prices themselves that make so-called bad deflation problematic, but the falling money supply that caused it.

Falling money supply itself is something that is worth trying to prevent for several reasons, most importantly the risk that falling prices in the absence of falling wages will create a rise in unemployment. Nonetheless, given any fall in the money supply, fully embracing lower prices and wages is the only way to limit the economic disruption.

The Great Depression Deflation Lesson

The Great Depression is often seen as an example of the risks posed by deflation as the economic contraction of the early-1930s occurred alongside a collapse in the general price level. However, in reality this period of economic history highlighted the importance of allowing prices to fall in the event of a contraction in the money supply. Falling prices at the time reflected the natural consequences of a collapse in the money supply owing to widespread bank failures. Policymakers believed that it was the fall in prices and wages themselves that were the ultimate cause of the economic weakness and so put in place policies to prevent prices and wages from falling in the mistaken belief that this would ‘spur demand’. With the natural tendency for prices and wages to fall prevented by government policy, the collapse in nominal GDP occurred through an inevitable fall in output rather than a fall in prices.

Lower Inflation Does Not Cause Higher Unemployment

Central banks have long worked under the assumption that there is a strong inverse link between unemployment inflation. They argue that the tighter the labour market, the higher wage pressures will be, and as wages are the main cost to businesses, inflation will rise. Similarly, monetary tightening can reduce inflation and increase unemployment.

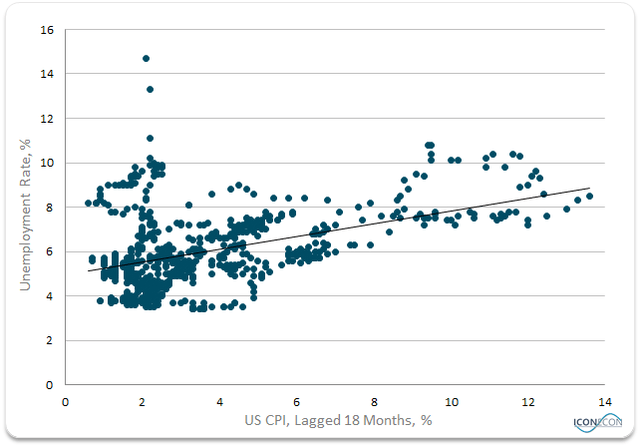

Lower Inflation Leads To Lower Unemployment

Source: Bloomberg

However, as the chart shows, there is no indication whatsoever that a lower unemployment rate causes higher inflation or vice versa. In fact, if we lag the unemployment rate we can see that declining inflation is associated with declining unemployment over the next 18 months.

Governments Love Inflation

Why is it then that in the face of logic, the fundamental theory of supply and demand, and a wealth of empirical evidence, deflation is still seen as a threat to economic wellbeing? As far as we can tell this mass…